Bitcoin is my Declaration of Independence

from the corrupt fiat system, and the power-hungry parasites whose bankrupt ideas depend on it.

On April 5th, 1933, FDR seized Americans’ gold holdings in order to debase the dollar by 75% (by resetting the gold exchange rate from $20 to $35). That was the first dollar default.

On August 15th, 1971, Nixon closed the gold window in order to stop foreign dollar holders from redeeming their holdings in gold. That was the second dollar default.

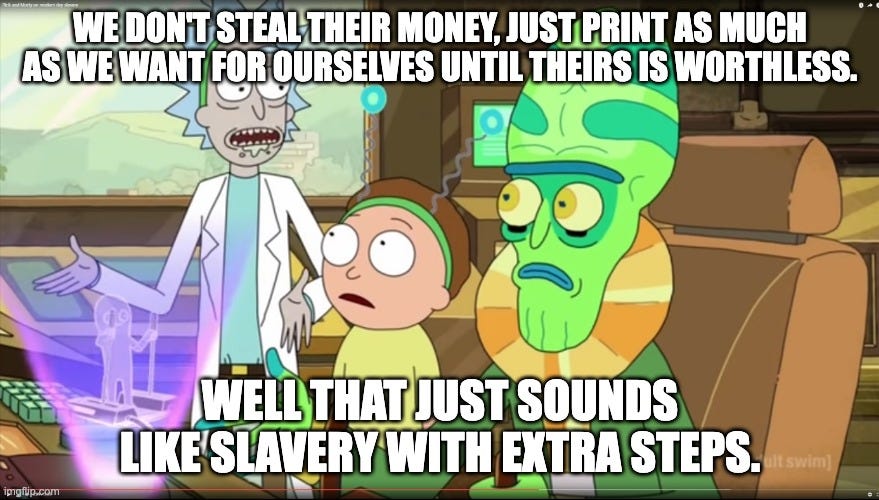

On February 24, 2022, the US treasury department held its own credibility at gunpoint, and pulled the trigger, mortally wounding the dollar. By taking away Russia’s ability to spend its reserves, the dollar’s “risk-free” global reserve currency status has ceased to be. It is no longer the neutral store of value that most continue to believe it is— and which it never really was. It is, and always has been, a tool for the administrative class to seize power and wealth at the expense of the plebs.

While not sufficient on its own to cause a third default, the dollar losing its global reserve currency status is an ominous milestone on the highway there. The third dollar default—hyperinflation—will be its last.

But so few people are aware of what is happening. So few are aware of the insidious nature of fiat currency. So few are aware of the inherent conflicts of interest and corruption it enables. Even among a skeptical public, few people understand the endemic lying, name-calling, and gaslighting required to keep the fiat ponzi-scheme afloat. And fewer still have any idea of what to do about it.

Therein lies my mission:

To evaluate Bitcoin criticism, honest and dishonest alike

To document and properly frame the story of fiat’s slow death

To save as many people as possible from the hell of currency debasement

Even as I glibly assert that fiat is dead, billions of people remain prisoners to its caprice. Day after day they work in futility for a better life that is perpetually out of reach. What should we call that, if not slavery?

But there is hope in Bitcoin. The implications of a Bitcoin standard are awesome!

War will become much harder to finance.

Bitcoin’s mutually-assured preservation of wealth will lower the return on violence.

Nations all over the world will be able to shrug off the political chains of predatory international loans.

Bitcoin will usher in a new era of clean, cheap energy. Seriously!

Before we can get there though, the plebs have to declare independence from the fiat monetary system. Until they do, they remain subject to fiat. And it is no accident that there is a daily barrage of FUD hit-pieces published criticizing Bitcoin.

FUD stands for fears, uncertainties, and doubts. You can recognize FUD by its shrill fear-stoking tone, and its lightness on evidence. There are a few honest critiques of Bitcoin, but the bullshit that is pedaled is ubiquitous because it is comparatively easy to produce.

I aim to increase the tail risk of publishing bullshit.

But in the meantime, these zombie narratives promoted by your masters will continue to persist. Here are just a few Bitcoin FUD greatest hits that I intend to tackle:

“Bitcoin is backed by nothing”

“Bitcoin is bad for the environment”

“Bitcoin is a ponzi scheme / scam”

“But who invented Bitcoin?!”

“Bitcoin is for criminals”

“Bitcoin will get banned”

“Bitcoin will get regulated”

“Bitcoin is speculative”

“Bitcoin has no inherent value”

“Bitcoin can’t scale”

“Bitcoin will get hacked”

“Bitcoin is centralized”

“Bitcoin has no privacy”

“Bitcoin is the same as ‘crypto’”

“Bitcoin is a solution in search of a problem”

“Bitcoin is useless, but blockchain is innovative”

“Bitcoin could have a backdoor in it”

…and whatever else the craven academics, bankers, bureaucrats, demagogues, and totalitarian technocrats cook up next!

In this inaugural declaration, I will close by saying that I take my mission very seriously. Even my own family is susceptible to these false narratives. There is a lot of work to do.

None of this is or ever will be financial advice. This is not the newsletter to read for hot Bitcoin trading tips. I simply aim to increase the signal-to-noise ratio.